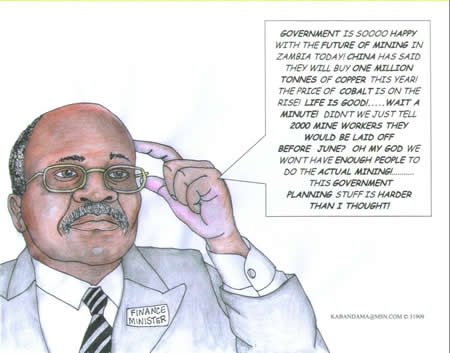

THE Bank of Zambia (BOZ) says the Kwacha is likely to record significant appreciation in view of the copper prices that have started rising.

BOZ governor, Caleb Fundanga, said this at a media briefing in Lusaka yesterday.

Dr Fundanga also reiterated the Central Bank’s ban of commercial banks from short term lending of huge sums of money to off shore borrowers for not more than one year to curb volatility in the exchange rate market.

He said of late, some foreigners could borrow as high as K100 billion payable within seven days at high interest rate which they used to buy the dollar and later sold the same on the Zambian exchange market.

Dr Fundanga said this was creating speculation and volatility in the Zambian exchange market.

He, however, said the country’s economic outlook was brighter especially with the copper prices that had started increasing and the anticipated rise in production of the commodity with the opening of Lumwana Mine.

Dr Fundanga said if inflation continued to lower like had been the case over the past two months, the central bank foresaw a 10 per cent target being met by June this year.

The annual inflation rate rose to 16.6 per cent in December last year due to the increase in food and non-food inflation, reflecting low maize supply and cereals coupled with high production costs of processed food items.

However, inflation levels slowed down to 16 per cent in January this year and further to 14 per cent last month.

Dr Fundanga attributed the decrease in inflation levels over the past two months to a decline in food inflation owing to the Food Reserve Agency’s subsidies and stable fuel prices.

He said the interest rates were market determined and were not fixed by the central bank.

Dr Fundanga said the central bank had seen a reduction in foreign reserves from over US$1 billion early last year to below US$900 million.

He said this was because the central bank was now doing more of selling of the dollar compared with early last year when it was buying the foreign currency due to too much dollar supply on the market.

Dr Fundanga said Zambia recorded an overall balance of payments (BoP) deficit of US$144.5 million during the fourth quarter of last year compared with a deficit of US$120.6 million recorded the previous quarter.

“This was largely on account of unfavourable performance in the current account that outweighed the improvements recorded in the capital and financial account,” he said.

Dr Fundanga said, however, that on annual basis, the overall BoP position recorded a surplus of US$45.7 million which was 85.3 per cent lower than the US$310.5 million recorded in 2007.

He also said a statutory instrument on anti-dollarisation would soon be issued so that the central bank could deal with business institutions that quoted prices of their goods and services in dollar.

Dr Fundanga said Zambia was the only country where dollarisation had been tolerated and that time had come to act against the trend.

[Zambia Daily Mail]