By Edward Chisanga

Introduction

Pareto’ principle, equally known as the 80/20 Rule, in my interpretation, states that if 80% of your income comes from 20% of activities or inputs, then it’s worth spending more resources and importance on what seems to be the small figure of 20%. Others state that for many events, roughly 80% of effects come from 20% of causes. Other experts say 80% of profits come from 20% of the products or services a company sells.

In the Public-Private sector partnership in Zambia (Private sector here seen as indigenous), ever since its inception many years ago, under successive Heads of State, the weight of importance is always skewed in favor of the former against the latter. In its history of squeaks and groans, with lubrication always allusive, the private sector has been the main complainant, often listing sensible and genuine rationale about what hinders its progress. While different governments in the past and perhaps present, have made promises to address private sector’s huddles, I do not remember a genuine solution ever put on the partnership table. And, perhaps it may never be coming home soon.

Who owns copper?

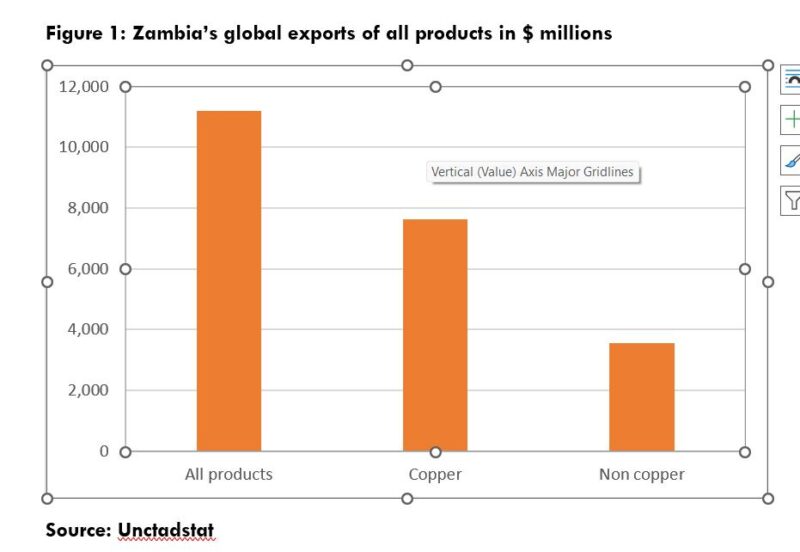

But the main story in my article is the substantive content of this partnership, in particular concerning trade. According to statistics, every Zambian perhaps knows that the nation’s global and regional trade continues to be dominated by the state. In Zambia’s total exports of all products put together, copper, despite legal ownership being in private hands by foreigners, is, I believe, still a state product, accounts for close to 70%. If copper is a state property, it then implies that the proportion of private sector exports in total is only 30%. In the total, this figure is marginal.

I illustrate this point also by simply showing the actual absolute export numbers. In Figure 1 below, in 2024 total exports of all products stood at $ 11.2 billion while copper exports alone were $7.6 billion, leaving a balance of non-copper exports of $3.6 billion only.

Are non-copper exports growing?

Methodology

Although indicators of growth often used are percentages, here, for the sake of simplicity and clear understanding to a layman and woman, I use annual growth in dollar absolute values. In other words, I subtract past export values from forward exports, for example exports of 1996 minus those of previous year of 1995 to get increase or decrease. I do this for each year and refer to it as growth.

My findings

My findings are shown in Figure 2. Yes, in terms of height, the lines in the graph going up imply that non-copper exports have been growing substantially. If percentages are used, it would show similar or the same image seen here, in terms of high lines. No wonder, those like me, familiar with government reporting on non-cooper or non-traditional exports beam with excitement and say, “Zambia’s non-traditional exports increase by 20%; Zambia’s non-traditional exports jump….”

But in value, this ‘jump’ is not so robust. Back to Figure 2. First, we must also have a conversation about lines going down in the graph. They’re as significant as their counterparts going up. We see minus $200million down in 2000, minus $300 million down in 2009, minus $825 million in 2014, minus $ 833 million in 2015, minus $200 million in 2019 and almost minus $600 million in 2024. For me, you can almost conclude that from 1996 – 2024, the balance sheet comprising positive growth and negative growth almost takes us to nil growth overall. Or the plusses and minuses end up cancelling each other to zero.

Second, if these upward lines or positive growths were in $ 5 billions annually, I would applaud the private sector. But they’re in small millions and at no point in a year do they ever reach $1billion. These are not numbers that can create the wealth citizens desperately need to fight the war against poverty and its concomitant effects. The period, 1996-2024 covered for this study is almost three decades with lackluster performance of non-copper exports. How long can we keep up appearances of Zambia’s private sector?

Figure 2: Growth of Zambia’s global exports of non-copper products in $millions

Implications

There’re implications for indigenous Zambia’s private sector. One is that given its fractured participation in substantive trade, with very basic performance, it means that it will continue to be marginalized. If we go back to the 80/20 rule, we can conclude that what makes it weak is that Zambia’s private sector is not generating competitive exports of non-copper products equaling government’s exports. If what makes government tick is copper exports, it means government will focus on that instead of non-copper exports and its owners.

Second, the private sector needs to match its strong vocal demands from government with robust performance. It needs to own up and tell Zambians that it’s equally at fault. A real aggressive and cognitive function-driven private sector matches on, even in what is perceived as mountains of impassable icebergs. It’s not all the Asian private sectors that are today competing with, and even outcompeting the US that were facilitated by government.

In fact, when it surpasses government in exports, not only quantitatively but qualitatively too, such as exports of manufactured goods, respect will grip government into submitting to the private sector’s calls. In fact, at that point, private sector will be in the front seat, replacing the current driver. That’s the conclusion too.

So much sense in this

Comments are closed.