ZAMBIA’s gross international reserves increased to US$1.9 billion in December last year from $1.8 billion in November.

The rise in the reserves followed the receipt of budget support from the European Union of $43.0 million, Poverty Reduction and Growth Facility (PRGF) loan receipt from the International Monetary Fund (IMF) of $80.0 million and Bank of Zambia (BoZ) purchases of foreign exchange from the market of about $15.0 million.

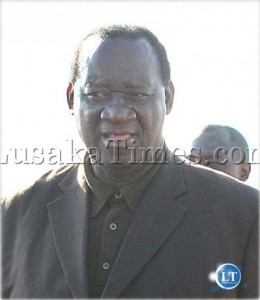

BoZ Governor, Caleb Fundanga said in Lusaka yesterday that the Net Foreign Assets (NFA) increased by 8.6 per cent during the fourth quarter of last year, contributing 5.2 per cent points to broad money (M3) expansion, mainly due to the rise in gross international reserves.

The NFA increased by 60.0 per cent compared with the 80.8 per cent recorded in September 2009, largely on account of the 6.6 per cent increase in the actual gross international reserves in the quarter under review.

Dr Fundanga said during a quarterly media briefing that during the fourth quarter, the Kwacha lost some of its previous quarter’s gains and posted marginal depreciations against the major currencies.

Accordingly, the Kwacha recorded 0.6 per cent depreciation against the US dollar mainly on the back of a stronger import demand for oil and agricultural inputs.

Similarly, the Kwacha made losses against the Euro, pound sterling and the South African rand.

Preliminary data shows that Zambia recorded an overall balance of payments (BoP) deficit of $113.1 million during the fourth quarter of 2009 compared with a surplus of $661.1 million recorded the previous quarter.

This was on account of unfavourable performance in both the current, capital and financial accounts.

Dr Fundanga said the overall financial condition of the banking sector during the fourth quarter was satisfactory.

The banking sector was adequately capitalised and the liquidity position remained satisfactory, while there were modest improvements in asset quality and earnings performance compared to the previous quarter.

On the inflation outlook, he said inflationary pressures in the first quarter of 2010 were expected to originate mainly from the recent 15 per cent adjustment in the prices of petroleum products in line with the rise in oil prices on the global markets.

Inflationary pressures were also expected to originate from price increases on services and manufactured goods in response to upward adjustments on water tariffs implemented in December 2009.

Other pressures would come from seasonal price increases on maize grain, various fresh vegetables and fish largely due to low supply of the commodities.

However, Dr Fundanga said Inflationary pressures would be moderated by the relative stability in the exchange rate of the Kwacha against major foreign currencies.

And Dr Fundanga reminded the public that bouncing cheques on an insufficiently funded account was a criminal offence under the National Payment System Act.

He said new directives regarding the bouncing of cheques offence would be issued in the first quarter of this year.

Meanwhile, the mining tax revenues paid in US dollars through BoZ stood at $77.7 million last year from $128.4 million in 2008.

The sales of foreign exchange to the market stood at $739.2 million in 2009 from $1,232.0 million the previous year.

[Times of Zambia]