The government has removed windfall tax in order to salvage the mining sector from collapse. However, the government has retained the variable profit tax , which will still capture any windfall gains that may arise in the sector.

Zambia’s mining sector which has seen some companies winding up has been badly affected due to the falling prices of copper and other commodities on the international market.

The global effects on the sector led to government collecting revenue of K319.5 billion last year, representing a 65 percent drop from the targeted K917.3 billion by the end of December 2008.

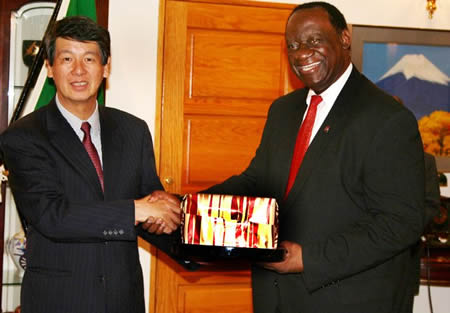

Finance and national planning minister Dr. Situmbeko Musokotwane said government has also allowed hedging income to be a part of the mining income for tax purposes and increased capital allowance to 100 percent as an investment incentive.

Dr. Musokotwane said’ that measures have been taken after consultations with the industry and other stakeholders and are in line with the impact of the global crisis on the sector.

He said the concession through which government will register a revenue loss of K19.3billion will come into effect from April 1, 2009.

Government has however maintained corperate tax at 30 percent, mineral royalty rate on base metals at 3 percent of gross value, withholding tax on interest , royalties management fees at 15 percent .

Government last year introduced a tax of 25 percent at the copper price of $US 2.50 per pound , 50 percent at price for the next 50 cents and increase in price and $US 75 percent for above $US 3.50 per pound.

These measures were intended to ensure that the nation received a fair return from its resources, while maintaining a globally competitive mining industry.

However the sector despite the challenges recorded a 4.9 percent growth as compared to 3.6 percent recorded for 2007.

Preliminary estimates indicate that copper production increased by 3.7 percent to 569,891 metric tones while Cobalt production increased by 19.5 percent from 4,414 metric tones in 2007 to 5,275 metric tones.

The Minister has further proposed to reduce customs duty on Heavy Oil from 30 to 15 percent and to remove customs duty on copper powder, copper flakes and copper blisters.

He has also proposed to include copper and cobalt concentrates on the import deferment scheme for Value Added Tax (VAT) purposes.

He stated that the measure will reduce the operating costs of mining companies as well as encourage the utilization of local smelting capacity.

ENDS/MKM/PKZANIS