Sishuwa Petitions President Over “Unconstitutional” ECZ Composition

Prominent academic and governance advocate Dr. Sishuwa Sishuwa has raised alarm over what he terms the “unconstitutional composition” of the Electoral Commission of Zambia (ECZ), urging President Hakainde Hichilema to urgently address the matter or risk undermining the credibility of the forthcoming elections.

In a strongly worded press statement issued on 25 September 2025, Dr. Sishuwa argued that the current four-member composition of the ECZ falls short of the constitutional requirements of inclusivity, regional balance, youth representation, and participation of persons with disabilities.

According to him, three of the current commissioners — Mrs. Frances Mwangala Zaloumis, Maj. Gen. Vincent Mbaulu Mukanda (Rtd), and Ms. Ndiyoi Muliwana Mutiti — all hail from Western Province, while the fourth, Mr. McDonald Chipenzi, comes from Southern Province. This, he said, leaves eight provinces without representation and excludes key demographic groups such as the youth (defined in law as under 35 years) and persons with disabilities.

Dr. Sishuwa contended that this arrangement violates several provisions of the Constitution, including Articles 259, 173, 23, 45, and 46, which collectively demand regional diversity, gender balance, inclusivity, and the fair participation of all groups in public institutions. “This exclusion undermines public confidence in the ECZ at a critical moment in our democracy,” he stated.

Through his legal representatives at Simeza | Sangwa & Associates, Dr. Sishuwa has since written to President Hichilema demanding corrective measures within 14 days. The lawyers warned that failure to act would compel their client to seek redress from the Constitutional Court. They are seeking a declaration that the current ECZ composition is unconstitutional and an order compelling government to ensure compliance with the constitutional provisions before the upcoming elections.

The matter touches on the integrity of Zambia’s electoral process, with critics warning that the exclusion of certain provinces and social groups could raise questions of bias and diminish public trust. “Every citizen has a stake in ensuring that our electoral body is representative, inclusive, and constitutional,” Dr. Sishuwa emphasised in his statement.

The full press statement and the detailed letter of demand to the President, copied to the Attorney General, the Speaker of the National Assembly, and the Chairperson of the ECZ, are below and attached images below

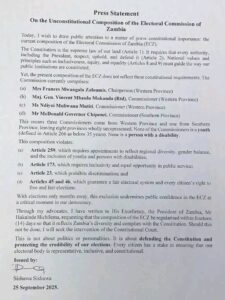

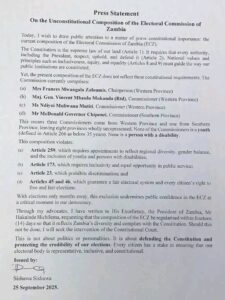

Press Statement

On the Unconstitutional Composition of the Electoral Commission of Zambia

Today, I wish to draw public attention to a matter of grave constitutional importance: the current composition of the Electoral Commission of Zambia (ECZ).

The Constitution is the supreme law of our land (Article 1). It requires that every authority, including the President, respect, uphold, and defend it (Article 2). National values and principles such as inclusiveness, equity, and equality (Articles 8 and 9) must guide the way our public institutions are constituted.

Yet, the present composition of the ECZ does not reflect these constitutional requirements. The Commission currently comprises:

(a) Mrs Frances Mwangala Zaloumis, Chairperson (Western Province)

(b) Maj. Gen. Vincent Mbaulu Mukanda (Rtd), Commissioner (Western Province)

(c) Ms Ndiyoi Muliwana Mutiti, Commissioner (Western Province)

(d) Mr McDonald Governor Chipenzi, Commissioner (Southern Province)

This means three Commissioners come from Western Province and one from Southern Province, leaving eight provinces wholly unrepresented. None of the Commissioners is a youth (defined in Article 266 as below 35 years). None is a person with a disability.

This composition violates:

(a) Article 259, which requires appointments to reflect regional diversity, gender balance, and the inclusion of youths and persons with disabilities;

(b) Article 173, which requires inclusivity and equal opportunity in public service;

(c) Article 23, which prohibits discrimination; and

(d) Articles 45 and 46, which guarantee a fair electoral system and every citizen’s right to free and fair elections.

With elections only months away, this exclusion undermines public confidence in the ECZ at a critical moment in our democracy.

Through my advocates, I have written to His Excellency, the President of Zambia, Mr Hakainde Hichilema, requesting that the composition of the ECZ be regularised within fourteen (14) days so that it reflects Zambia’s diversity and complies with the Constitution. Should this not be done, I will seek the intervention of the Constitutional Court.

This is not about politics or personalities. It is about defending the Constitution and protecting the credibility of our elections. Every citizen has a stake in ensuring that our electoral body is representative, inclusive, and constitutional.

Issued by:

Dr. Sishuwa Sishuwa

25 September 2025

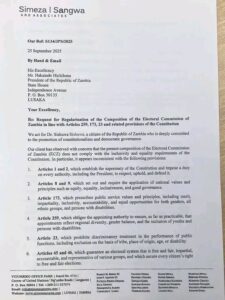

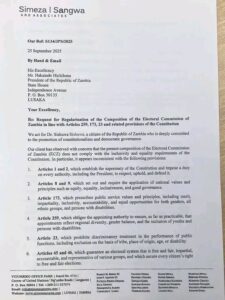

Simeza | Sangwa & Associates

Our Ref: S1344/PS/2025

25 September 2025

By Hand & Email

His Excellency

Mr Hakainde Hichilema

President of the Republic of Zambia

State House

Independence Avenue

P.O. Box 30135

LUSAKA

Your Excellency,

Re: Request for Regularisation of the Composition of the Electoral Commission of Zambia in line with Articles 259, 173, 23 and related provisions of the Constitution

We act for Dr. Sishuwa Sishuwa, a citizen of the Republic of Zambia who is deeply committed to the promotion of constitutionalism and democratic governance.

Our client has observed with concern that the present composition of the Electoral Commission of Zambia (ECZ) does not comply with the inclusivity and equality requirements of the Constitution. In particular, it appears inconsistent with the following provisions:

-

Articles 1 and 2, which establish the supremacy of the Constitution and impose a duty on every authority, including the President, to respect, uphold, and defend it.

-

Articles 8 and 9, which set out and require the application of national values and principles such as equity, equality, inclusiveness, and good governance.

-

Article 173, which prescribes public service values and principles, including merit, impartiality, inclusivity, accountability, and equal opportunities for both genders, all youths, and persons with disabilities.

-

Article 259, which obliges the appointing authority to ensure, as far as practicable, that appointments reflect regional diversity, gender balance, and the inclusion of youths and persons with disabilities.

-

Article 23, which prohibits discriminatory treatment in the performance of public functions, including exclusion on the basis of tribe, place of origin, race, gender, or disability.

-

Articles 45 and 46, which guarantee an electoral system that is free and fair, impartial, and inclusive, representative of various groups, and which secure every citizen’s right to free and fair elections.

-

Article 266, which defines a youth as a person below thirty-five (35) years of age.

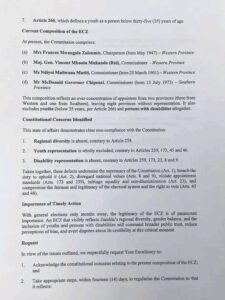

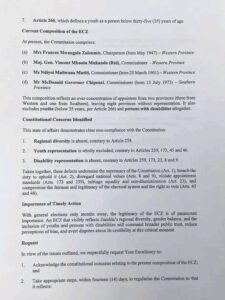

Current Composition of the ECZ

At present, the Commission comprises:

(a) Mrs Frances Mwangala Zaloumis, Chairperson (born May 1947) – Western Province

(b) Maj. Gen. Vincent Mbaulu Mukanda (Rtd), Commissioner – Western Province

(c) Ms Ndiyoi Muliwana Mutiti, Commissioner (born 25 March 1961) – Western Province

(d) Mr McDonald Governor Chipenzi, Commissioner (born 15 July 1973) – Southern Province

This composition reflects an over-concentration of appointees from two provinces (three from Western and one from Southern), leaving eight provinces without representation. It also excludes youths (below 35 years, per Article 266) and persons with disabilities altogether.

Constitutional Concerns Identified

This state of affairs demonstrates clear non-compliance with the Constitution:

-

Regional diversity is absent, contrary to Article 259.

-

Youth representation is wholly excluded, contrary to Articles 259, 173, 45 and 46.

-

Disability representation is absent, contrary to Articles 259, 173, 23, 8 and 9.

Taken together, these defects undermine the supremacy of the Constitution (Art. 1), breach the duty to uphold it (Art. 2), disregard national values (Arts. 8 and 9), violate appointment standards (Arts. 173 and 259), infringe equality and non-discrimination (Art. 23), and undermine the fairness and legitimacy of the electoral system and the right to vote (Arts. 45 and 46).

Importance of Timely Action

With general elections only months away, the legitimacy of the ECZ is of paramount importance. An ECZ that visibly reflects Zambia’s regional diversity, gender equality, and meaningful inclusion of youths and persons with disabilities will command broader public trust, reduce perceptions of bias, and avert disputes about its credibility at this critical moment.

Request

In view of the issues outlined, we respectfully request Your Excellency to:

-

Acknowledge the constitutional concerns relating to the present composition of the ECZ; and

-

Take appropriate steps, within fourteen (14) days, to regularise the Commission so that it reflects:

(a) the regional diversity of the Republic;

(b) equitable gender balance; and

(c) the meaningful inclusion of youths and persons with disabilities, as envisaged by Articles 259, 173, 23, 45, 46 and related provisions of the Constitution.

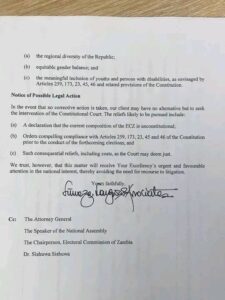

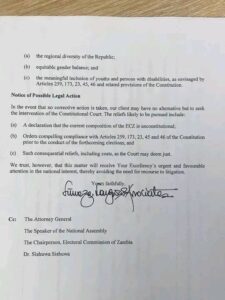

Notice of Possible Legal Action

In the event that no corrective action is taken, our client may have no alternative but to seek the intervention of the Constitutional Court. The reliefs likely to be pursued include:

(a) A declaration that the current composition of the ECZ is unconstitutional;

(b) Orders compelling compliance with Articles 259, 173, 23, 45 and 46 of the Constitution prior to the conduct of the forthcoming elections; and

(c) Such consequential reliefs, including costs, as the Court may deem just.

We trust, however, that this matter will receive Your Excellency’s urgent and favourable attention in the national interest, thereby avoiding the need for recourse to litigation.

Yours faithfully,

Simeza Sangwa & Associates

Cc: The Attorney General

The Speaker of the National Assembly

The Chairperson, Electoral Commission of Zambia

Dr. Sishuwa Sishuwa