ACCESS Bank Zambia has introduced on the market two facilities that make it difficult for swindlers to fraudulently access other people’s bank accounts or replicate automated teller machine (ATM) cards, frauds which the market has witnessed in recent weeks.

The bank was the first in Zambia to introduce a debit card that has a microscopic chip and pin facility to prevent fraudulent access to accounts.

Access Bank Zambia head of corporate communications and brand management, Glenda Tutula said the bank designed the chip and pin facility to reduce fraudulent incidences and protect customers from such practices.

Ms Tutula said the bank was the first in Zambia to introduce the ‘chip and pin’ facility, and was committed to enhancing security measures to increase safety among customers. The card is acceptable for use at ATMs globally.

She said the bank had also introduced the Access debit alert facilities, equally designed to protect its clients from fraud as the customer is notified automatically and electronically through the mobile phone at any time that a transaction takes place.

“Access Bank has introduced access debit alert, a text message which would be reflecting on the customer’s phone indicating that a transaction was being carried out,” he said.

Whenever money was being withdrawn from a client’s account, the system would send a text message to the customer detailing the time and date when the transaction took place as well as the branch where it was transacted and how much money was withdrawn.

“We have decided to come up with the chip and pin debit card and the access debit alert to protect our customers from being swindled and I am very optimistic this will increase our safety measures and help reduce incidences of fraud,” she said.

Ms Tutula said all Access Bank clients would have the chip and pin debit card and would be receiving a text message of their mobile phones through the access alert service.

The facility could help in addressing the frauds that some banks in the country have reported in recent weeks through the Bankers Association on Zambia (BAZ).

Meanwhile, the Bank of Zambia (BOZ) has said it is aware of the reported frauds presented by BAZ and the central bank is awaiting a comprehensive report from the association for it to determine the extent and amount of money lost in the recently reported frauds through debit cards and act accordingly.

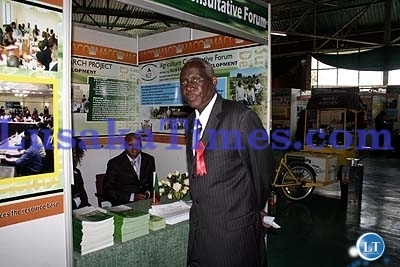

BoZ governor, Caleb Fundanga has described the incidences as a temporary setback in efforts that the banking system in Zambia has been putting in place to avoid fraud.

Dr Fundanga said at the just-ended Zambia Agriculture and Commercial Show that there was need to maintain progress on the measures, especially through automation of transactions.

[pullquote]However, they said preliminary reports indicated that the most affected were retail bank customers who travelled and sought bank services from neighbouring countries.

[/pullquote]

Earlier, BoZ head of public relations Kanguya Mayondi had said the central bank was aware and was monitoring fraud reports through the updates obtained from BAZ, but could only act upon receiving a full report.

“BOZ is aware of the fraud cases reported by individual financial institutions through BAZ, but we will act on the matter upon receiving a comprehensive report from the bankers’ body,” said Mr Mayondi.

Debit card fraud alarms were recently revealed by some retail banking customers in Zambia who reported suspicious debit card transactions on their accounts across some local financial institutions.

However, they said preliminary reports indicated that the most affected were retail bank customers who travelled and sought bank services from neighbouring countries.

[Times of Zambia]