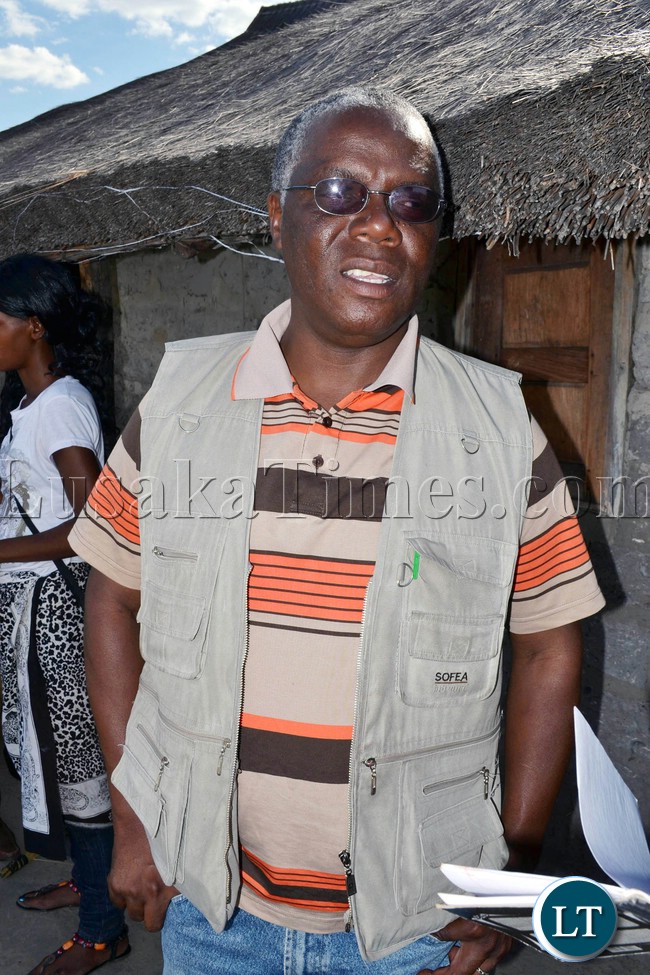

President of the Young African Leaders Initiative Andrew Ntewewe has defended the organisation’s leaked document which he calls the Constitution Masterplan in which the organisation is proposing that the 2016 general elections be held under the current constitution.

Addressing a news conference Wednesday morning, Mr Ntewewe defended the proposal saying it is the best one for Zambia’s democracy.

“It is a proposal and stakeholders are free to debate it and refine it. We believe it will help us save cost and ultimately arrive at a new constitution for the Republic of Zambia,” Mr Ntewewe said.

He also denied that YALI has been compromised by state agencies.

“It is incorrect to state that this proposal shows that we have been bought or compromised. We made the proposal in the spirit of give and take and promotion of democracy. We have not been compromised,” he said.

Mr Ntewewe explained that YALI is not going against the position of the Grand Coalition of the Constitution which has been fighting for a new constitution.

“We are not deferring with our coalition partners. We are simply offering alternative view point,” he said.

Asked why YALI submitted the document to the Ministry of Justice behind the back of its partners in the Grand Coalition, Mr Ntewewe explained that YALI was going to discuss the master plan after receiving feedback from the Ministry.

“We were going to share this document with everyone. It was never going to be a secret. We don’t understand why the Ministry is even treating it as a secret document. These are just our thoughts as an organisation,” he said.

Under the proposal dated May 13, 2014, submitted to the government, YALI is proposing that the 2016 general elections be held under the current Constitution as amended in 1996.

It said it is of the view that the public allows reasonable time for Cabinet to endorse the work of the technical committee appointed to draft the constitution and provide authority for the release of the draft constitution to the public.

YALI proposed that a national referendum be held alongside the 2016 general elections and that the new constitution should be adopted during the first sitting of parliament after the elections.

“The cost of running a referendum is equivalent to the cost of running a general election. YALI is aware that the approximate cost of the 2011 general elections stood at K322 million and so if the referendum is held separately any time before 2016, taxpayers will have to spend more than K800 million to which government urges that it would have to divert funds from priority areas such as health, education, agriculture and infrastructure development.”

In view of the above, YALI proposed the holding of the referendum alongside the 2016 general elections,” the document stated.

“The new constitution should be operationalised in 2017. By implications, the 2016 general elections will be held under the 1996 Constitution of Zambia,” YALI, which is party to the Grand Coalition agitating for the release of the draft constitution to the public, stated.

YALI proposed that beginning January 2016, until the time when the referendum is held, the Electoral Commission of Zambia should conduct voter registration exercise and update the voters roll by ensuring eligible voters were captured and ready to participate in the referendum.